AI Expansion Bolsters Optimism in Home Office Furniture Market

The home office furniture sector has been a stand-out performer in the broader furniture industry, especially during the pandemic as millions of people transitioned to remote work. However, as the world slowly returns to normalcy, the industry is witnessing a decline in sales and grappling to regain its momentum.

The home office category makes up about 5% of the total business for many whole home providers, as stated by Rodd Rafieha, a chief sales officer at Abbyson. The company experienced a significant surge in sales when the pandemic first hit. However, as the workforce stabilizes, sales have plateaued and aren’t expected to see another massive lift for overall annual performance. There will be peak seasons for the category, such as the back-to-school period.

Other whole home suppliers like Bernards share similar sentiments. The company’s president and COO, Micah Swick, anticipates a slight weakening in the market in the short term as some workers transition back to their offices but expects sales to remain above pre-pandemic levels. In the long term, he believes that advancements in AI will create opportunities for more individuals to become entrepreneurs or work remotely.

Technology’s impact on the industry is also reflected in the views of Century Furniture. The company sees growth in the home office category but also acknowledges that as technology continues to evolve and the need for large equipment and printed materials decreases, so will the demand for bulky storage units designed to store such items.

Interestingly, companies that specialize in home office furniture are more optimistic. BDI, a company specializing in home office and entertainment furniture, has seen an increase in demand. According to Dave Adams, BDI’s VP of marketing, consumers are still investing in their homes and creating permanent solutions where they previously had temporary ones. The shift in consumer mindset now views the home office as an integral part of the home rather than an afterthought.

Martin Furniture, another specialist in home office and entertainment furniture, also believes that the home office is still its strongest category. The company’s VP of sales, Dee Maas, predicts that sales will continue to grow as working from home remains a strategy for most companies. The tight labor market has led many companies to look outside their geographic locale for remote workers, leading to an increase in home offices.

When it comes to choosing furniture, consumers are increasingly prioritizing aesthetics over functionality. For instance, Swick at Bernards believes that consumers are seeking fashionable designs over storage as the need for paper files decreases and laptops and tablets become more powerful.

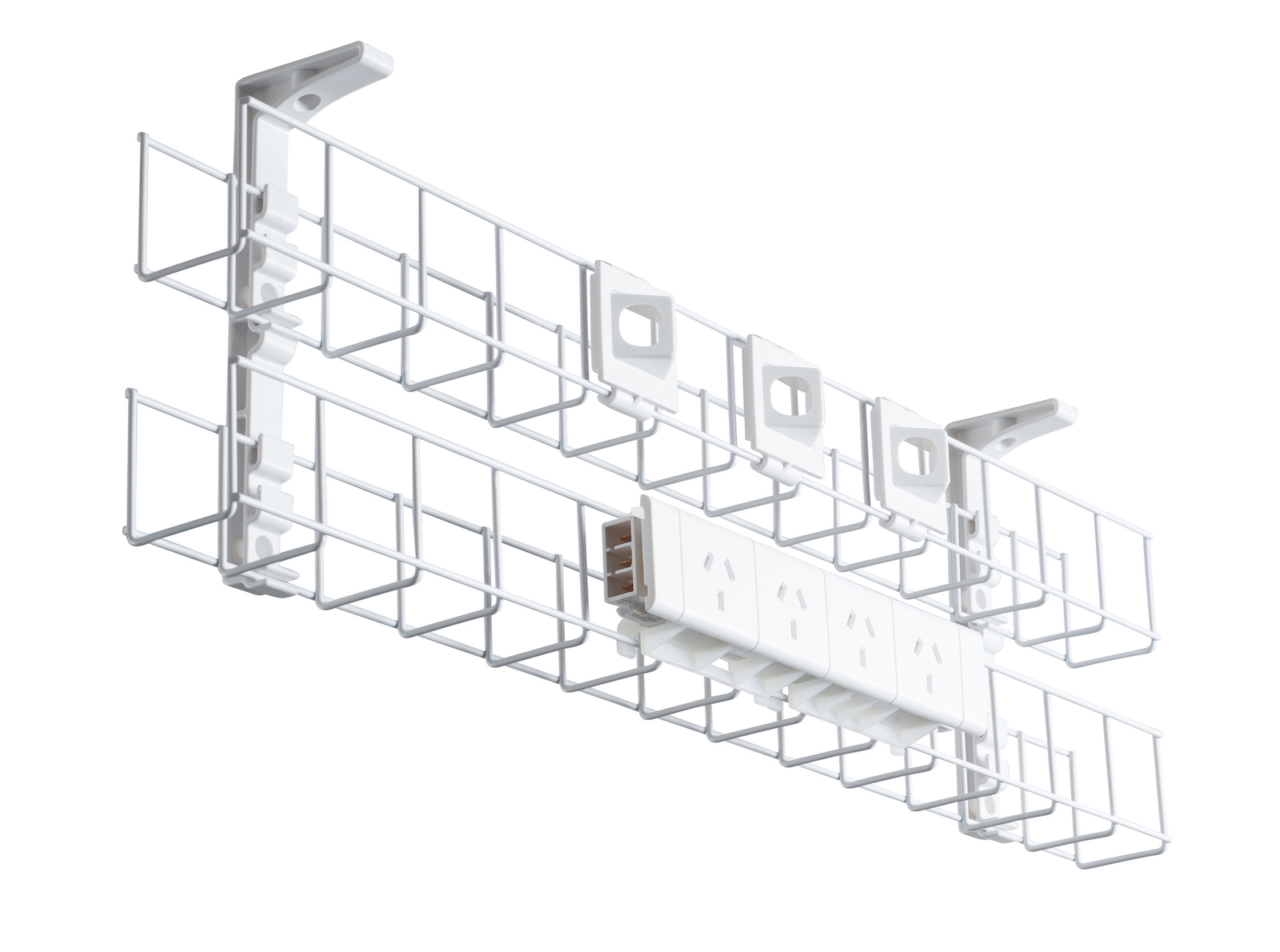

However, this doesn’t mean functionality is completely disregarded. Companies like Aspenhome are witnessing a surge in demand for executive desks, writing desks, and lift desks that support the work-from-home revolution. Additionally, the need for function-forward designs, storage, and multipurpose work surfaces has increased.

Specifically, L-shaped desks are outselling other profiles, and electric height adjustable standing desks continue to grow in popularity. Sit stand desks are also strong performers, as they offer health benefits of an electric stand up desk. The company’s mobile workstations are also popular.

In conclusion, while the home office furniture industry may be experiencing a decline in sales, it is far from out. As remote work becomes a long-term strategy for many companies and consumers continue to invest in their homes, the industry is poised to continue growing. The key to success lies in understanding and adapting to changing consumer preferences, whether it’s a shift towards more aesthetically pleasing designs or the increasing demand for the best sit stand desk.