Hong Kong Professionals Flock to Learn Family Office Management

In the heart of Hong Kong, amidst a sweltering summer evening, a diverse group of individuals made their way past traditional ginseng dispensaries and bespoke tailoring establishments to attend a unique educational session. The topic of discussion was the rising trend of family offices in the city, a phenomenon that has taken the finance sector by storm. This eclectic group, composed of private bankers carrying gym bags and accountants attired in formal wear, had gathered to understand the ins and outs of family offices.

Family offices are firms dedicated to managing vast and often secretive wealth pools that span generations. Their clientele typically includes politically exposed persons, and their services extend beyond simple wealth management to encompass a range of ‘soft skills’ such as understanding the intricacies of fine Swiss watches or the nuances of fine art.

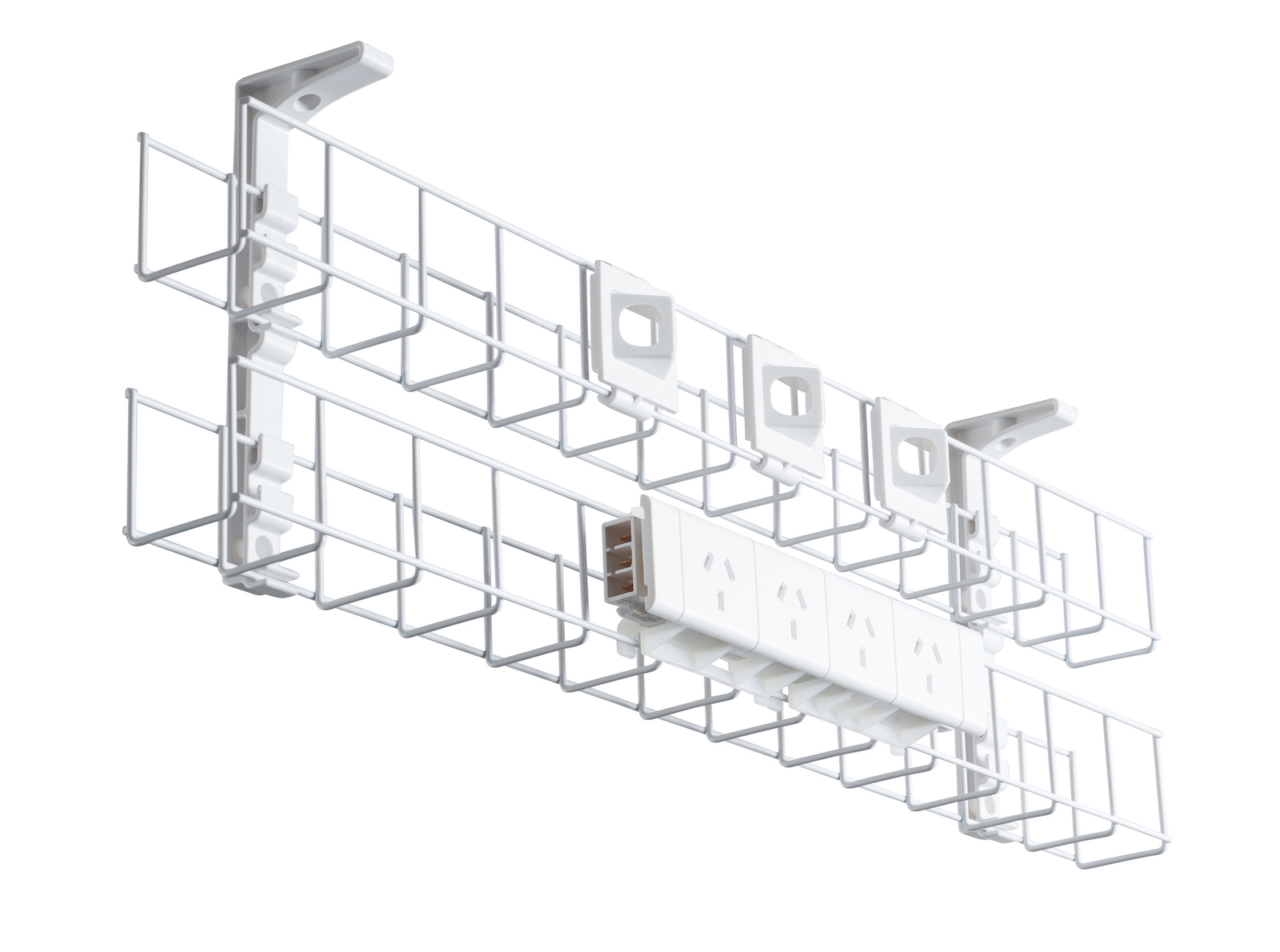

This rising trend of family offices in Hong Kong has been driven by several factors. The city’s robust financial infrastructure, its strategic location, and its ability to attract wealthy individuals from across the globe have all played a role. Moreover, Hong Kong’s reputation as a hub for luxury goods and services – think the best sit stand desk for the discerning executive or the health benefits of an electric stand up desk for the health-conscious billionaire – has only added to its allure.

However, managing a family office is no easy task. It requires a deep understanding of financial markets, investment strategies, and risk management. Additionally, family offices often need to navigate complex regulatory environments and deal with potentially sensitive political situations. This is where education and training come into play.

Institutions in Hong Kong are now offering courses designed to equip individuals with the skills needed to manage a family office successfully. These courses cover a range of topics, from understanding the intricacies of global finance to developing the soft skills necessary to cater to the unique needs and tastes of wealthy clients. For example, an individual working in a family office might need to understand the difference between an electric height adjustable standing desk and a regular desk when furnishing an office space for a client.

The rise of family offices also has significant implications for Hong Kong’s economy. As more wealth is managed through these offices, there will be increased demand for a range of services, from legal and accounting to luxury goods and services. This could lead to job creation and stimulate economic growth.

Moreover, the growth of family offices could also have a transformative effect on Hong Kong’s financial sector. As more money is managed through these offices, traditional banks and asset management firms might need to rethink their strategies and business models.

In conclusion, the rise of family offices in Hong Kong represents a significant shift in the city’s financial landscape. It presents both opportunities and challenges for individuals working in this sector, as well as for Hong Kong’s economy as a whole. As this trend continues to grow, it will be interesting to see how it shapes the future of finance in one of Asia’s most vibrant cities.